nwalliance.ru

Market

Average Interest Rate For Jumbo Loan

A jumbo loan is a mortgage for higher loan amounts. Get information about jumbo mortgages and view loan rates in your area. What is the typical rate for jumbo loan products? Preview a general guide As a result, jumbo loans typically carry higher interest rates than conventional. Find average mortgage rates for the 30 year jumbo fixed mortgage from Mortgage News Daily and the Mortgage Bankers Association. Freddie Mac, Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred. The national average year fixed jumbo refinance interest rate is %, down compared to last week's of %. 1. Minimum Credit Score. A higher loan amount, shortened loan term or adjustable interest rate may require you to have a higher. Current mortgage rates ; 3/1 ARM jumbo, %, % ; year fixed-rate jumbo, %, % ; year fixed-rate, %, % ; year fixed-rate, %, %. Conforming loans ; %. down %. %. down % ; %. up %. %. up %. As of September 2, , the average Jumbo mortgage APR is %. So a good jumbo mortgage rate is generally one that's close to or better than the average. A jumbo loan is a mortgage for higher loan amounts. Get information about jumbo mortgages and view loan rates in your area. What is the typical rate for jumbo loan products? Preview a general guide As a result, jumbo loans typically carry higher interest rates than conventional. Find average mortgage rates for the 30 year jumbo fixed mortgage from Mortgage News Daily and the Mortgage Bankers Association. Freddie Mac, Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred. The national average year fixed jumbo refinance interest rate is %, down compared to last week's of %. 1. Minimum Credit Score. A higher loan amount, shortened loan term or adjustable interest rate may require you to have a higher. Current mortgage rates ; 3/1 ARM jumbo, %, % ; year fixed-rate jumbo, %, % ; year fixed-rate, %, % ; year fixed-rate, %, %. Conforming loans ; %. down %. %. down % ; %. up %. %. up %. As of September 2, , the average Jumbo mortgage APR is %. So a good jumbo mortgage rate is generally one that's close to or better than the average.

The best jumbo loan lenders · Best overall jumbo lender: Ally Bank · Best for low-credit jumbo loans: Veterans United · Best for high loan amounts: Chase Bank. Jumbo loans: The annual percentage rate (APR) calculation assumes a $, fixed-term loan with a 25% down payment and borrower-paid finance charges of %. In Texas, loan limits are pegged at $ If you take out a home loan that exceeds that amount, you will need a jumbo mortgage. Current Mountain View Super Jumbo Mortgage Rates ; Mechanics Bank. NMLS # · % · $4, /mo · % ; Mutual of Omaha Mortgage, Inc. NMLS # · %. Jumbo mortgage rates tend to be higher than the rates for conventional, conforming loans. In the past, you may have had to pay % to 1% more for a jumbo. Find average mortgage rates for the 30 year jumbo fixed mortgage from Mortgage News Daily and the Mortgage Bankers Association. Jumbo loan rates tend to be slightly higher. You can expect to pay a mortgage interest rate that's between and 1 percentage point higher on a jumbo loan. Explore jumbo loan rates and features. With a jumbo loan you can enjoy an increased purchase limit and a competitive rate for higher-priced properties. Today's Jumbo Mortgage Rates ; LoanFlight Lending, LLC. NMLS # · % · $1, /mo · % ; New American Funding, LLC. NMLS # · % · $1, /mo. Just like with any mortgage interest, jumbo loan rates vary depending on several factors. The lowest rates you see advertised seldom apply to the majority. BMO Prime Mortgage Rate is %. Special Rates. Bring out the calculator. Find some help estimating your mortgage payments, how much you can afford and more. 3, , was %. Along with other mortgage interest rates, those for jumbo loans plummeted during the height of the COVID pandemic to reach a low of. Interest rates for high-balance Jumbo loans are typically higher, but the actual rate can vary greatly depending on many factors such as the borrower's loan. The most important difference is the interest rates issued for each. Jumbo loans normally carry a slightly higher interest rate ranging from % to %. For a jumbo loan with a rate of %, the principal and interest payment would be just $ a month for every $, borrowed, or $3, on a $, loan. The national average for a year fixed-interest rate for a jumbo loan is currently %, compared to the national average for a year fixed-rate mortgage. As of today, September 3rd, , the year fixed VA loan purchase rate is % — higher compared to last week's average. Today's year fixed VA refinance. Rates by loan type. mobile icon. APR vs. interest rate. mobile icon. Credit score range. mobile icon. Comparing rates. mobile icon. Inflation & interest rates. Jumbo: The average contract interest rate for year fixed mortgages with jumbo loan balances (greater than $,) was % during that same week. So. Competitive interest rates: Though jumbo loans have historically come with higher interest rates, lenders have realized that borrowers of jumbo loans can be.

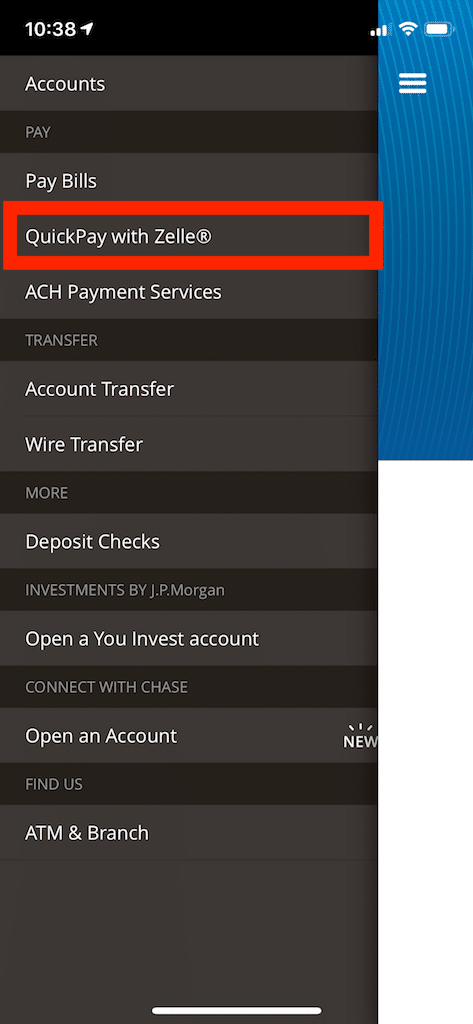

Quick Pay Zelle

Chase QuickPay is a free, secure way to send and receive money through Zelle, a person-to-person payment service available to almost anyone with an account at. With Zelle®, you can pay and get paid free and fast with your checking account. Get Checking. WHY USE ZELLE®? clock. Speedy. Pay and get paid in minutes. Chase QuickPay® with Zelle® is now just Zelle. Send and receive money in moments Footnote(Opens Overlay) so no more waiting days or paying fees like other apps. From the Huntington Mobile app, tap on Payments and then click to Enroll. Pick the contact method you will use with Zelle®—either an email address or U.S.-based. Need to split the lunch tab with friends or pay the babysitter? Now you can use Zelle® with friends and family to send and receive money directly with almost. To get started, log into Panhandle Credit Union's online banking or mobile app, navigate to Bill Pay and select "Send Money with Zelle®". Accept terms and. Open the Bank of America® Mobile Banking app. Sign in and tap "Pay & Transfer," then Zelle® and follow the on-screen instructions. Quick Pay allows you to make loan payments using an account from another financial institution. Enroll today at Teachers Federal Credit Union. Sign on to the Wells Fargo Mobile app > Pay & Transfer > Zelle > Send > select + to add a recipient. Enter [email protected] and American Red. Chase QuickPay is a free, secure way to send and receive money through Zelle, a person-to-person payment service available to almost anyone with an account at. With Zelle®, you can pay and get paid free and fast with your checking account. Get Checking. WHY USE ZELLE®? clock. Speedy. Pay and get paid in minutes. Chase QuickPay® with Zelle® is now just Zelle. Send and receive money in moments Footnote(Opens Overlay) so no more waiting days or paying fees like other apps. From the Huntington Mobile app, tap on Payments and then click to Enroll. Pick the contact method you will use with Zelle®—either an email address or U.S.-based. Need to split the lunch tab with friends or pay the babysitter? Now you can use Zelle® with friends and family to send and receive money directly with almost. To get started, log into Panhandle Credit Union's online banking or mobile app, navigate to Bill Pay and select "Send Money with Zelle®". Accept terms and. Open the Bank of America® Mobile Banking app. Sign in and tap "Pay & Transfer," then Zelle® and follow the on-screen instructions. Quick Pay allows you to make loan payments using an account from another financial institution. Enroll today at Teachers Federal Credit Union. Sign on to the Wells Fargo Mobile app > Pay & Transfer > Zelle > Send > select + to add a recipient. Enter [email protected] and American Red.

Quick Pay allows you to make loan payments using an account from another financial institution. Enroll today at Teachers Federal Credit Union. The NUQuickPay program is a way for Northwestern to pay people electronically via Zelle or ACH. This is available to individuals (eg, visitors, research. WHAT IS Zelle? Zelle is a fast, safe and easy way to send money directly between almost any bank accounts in the U.S., typically within minutes¹. With just an. Zelle® Fast Facts. What is Zelle®? Your Browser does not support HTML5 Pay it Safe with Zelle®. Discover the tactics scammers use and learn how to. Zelle is a quick way to pay people you know and trust in minutes. The email address to use when setting up your gift is give@oldstmarys. You can set-up your United Bank Loan payment in YOUR Bank's Bill Pay and make payments through their online/mobile banking. Can I use Venmo or Zelle to make a. Quick Pay is a FREE online payment service that offers you a fast and convenient way to pay your Bank Midwest loans directly from any checking or savings. Setup Bill Pay. Sending money is easy with Zelle®. Send or receive money from Let Zelle® work for you with quick, easy access to send money. Man and. Below, CNBC Select outlines how Zelle payments At the same time, the fact that Zelle transfers are quick and irreversible makes it an attractive target for. Digital Banking comes with the convenience of making one-time and recurring payments with Bill Pay. Save time with this no-cost personal deposit account. Zelle® has partnered with leading banks and credit unions across the U.S. to bring you a fast, safe and easy way to send money to friends and family. Hi everyone, Normally, I am able to transfer money from my WF and other accounts to Chase through Zelle / QuickPay. There are so many ways to make a payment: eTransfers, eDeposits, QuickPay, Zelle, and Mobile Payments; Business: eTransfers, eDeposits, QuickPay, Bill Pay. Day-to-day banking is easy with TD Bank digital payment options. Make transfers, pay your friends and family using Send Money with Zelle®1, set up Bill Pay. Zelle®, Duke Energy and Comcast logos shown in the app]. All payees you have Set up one-time or recurring payments with Bill Pay. You can even pay. Chase QuickPay with Zelle is a person-to-person payment service that lets you send and receive money from anyone with a U.S. bank account. Bill Pay is the easiest, fastest, and most advanced way to manage your bills. Here are just a few things you can do. Zelle is a fast, safe and easy way to send money directly between almost I'm unsure about using Zelle to pay someone I don't know. What should I do. There are so many ways to make a payment: eTransfers, eDeposits, QuickPay, Zelle, and Mobile Payments; Business: eTransfers, eDeposits, QuickPay, Bill Pay. Enroll Now to Get Started · Log in to Bill Pay · Select "Send Money With Zelle®" · Enroll your U.S. mobile number or email address · You're ready to start sending.

Fha Government Loans Review

:max_bytes(150000):strip_icc()/FHAnew-V1-a128f12bf4584ae8a9a5b7d0214cd8e4.png)

Low down payment requirements plus your credit score typically won't negatively impact your rate. Downside is upfront and monthly mortgage. Congress authorized HUD to create the HECM program to encourage lenders to make reverse mortgage loans that would better enable seniors to tap into their home. Benefits and Drawbacks of FHA Loans · The down payment can be as low as of % for borrowers with a credit score of or higher. · Those with a down payment of. The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. FHA Government Loans We encourage users to use the free NMLS Consumer Access Link to confirm that the mortgage company or mortgage professional with whom they. At this time, it only takes a credit score to qualify for a loan, according to the FHA. Smaller down payment: Whereas conventional mortgages often require. It's a government backed loan. It allows for low down payment and a lower credit score in order to qualify. It requires PMI, a monthly insurance. The FHA program allows some of the easiest lending standards in the market today. The program is a great fit for first-time buyers, those with small down. FHA loans are government-backed mortgage loans with requirements that are easier to qualify for than conventional loans. An FHA loan gives people with. Low down payment requirements plus your credit score typically won't negatively impact your rate. Downside is upfront and monthly mortgage. Congress authorized HUD to create the HECM program to encourage lenders to make reverse mortgage loans that would better enable seniors to tap into their home. Benefits and Drawbacks of FHA Loans · The down payment can be as low as of % for borrowers with a credit score of or higher. · Those with a down payment of. The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. FHA Government Loans We encourage users to use the free NMLS Consumer Access Link to confirm that the mortgage company or mortgage professional with whom they. At this time, it only takes a credit score to qualify for a loan, according to the FHA. Smaller down payment: Whereas conventional mortgages often require. It's a government backed loan. It allows for low down payment and a lower credit score in order to qualify. It requires PMI, a monthly insurance. The FHA program allows some of the easiest lending standards in the market today. The program is a great fit for first-time buyers, those with small down. FHA loans are government-backed mortgage loans with requirements that are easier to qualify for than conventional loans. An FHA loan gives people with.

The CalPLUS FHA Program is a first-time homebuyer mortgage loan that offers built-in down payment assistance at zero interest. If you have less-than-perfect credit or a lower income, getting a mortgage backed by the Federal Housing Administration (FHA) could be a great option. These loans, backed by the Federal Housing Administration (FHA), allow a down payment as low as % with a credit score down to After the lender reviews your completed application and conducts a credit check, you can get pre-approved. Getting pre-qualified is a valuable part of the. One of the benefits of FHA loans is that the interest rates can sometimes be lower than conventional mortgages because, as government-backed loans, lenders view. FHA provides mortgage programs with lower requirements. This makes IT easier for most borrowers to qualify, even those with questionable credit history and low. FHA loans are backed by the Federal Housing Administration, which makes them less risky for mortgage lenders to offer and allows for lower credit score. FHA loans are backed by the Federal Housing Administration and offered by FHA-approved lenders. · FHA loans allow smaller down payments (as low as %) and. The Federal Housing Finance Agency (FHFA) is an independent agency Provide input on matters under review or submit comment on proposed rules. The program provides a 90% loan note guarantee to approved lenders in order to reduce the risk of extending % loans to eligible rural homebuyers – so no. FHA loans are often the best source of a mortgage for borrowers who are unable to obtain financing through private lenders. They may qualify for an FHA loan. Best FHA Lender for an Easy Online Experience: Rocket Mortgage It indicates a confirmed selection. Offers affordable mortgage programs, including lender. The Federal Housing Administration (FHA) provides insurance to private lenders, giving them the confidence to allow homeowners to borrow money for critical home. This program streamlines the loan approval process, benefiting both borrowers and lenders, as it reduces paperwork and processing time. However, lenders are. Individuals with a credit score of to are eligible for an FHA loan with a down payment as low as %. The FHA program even offers a special (k) loan. The CalHFA FHA program is a first mortgage loan insured by the Federal Housing Administration Review the guidelines below for both Borrower and Property. The Mortgagee Review Board (Board) was established in the Federal Housing Administration HUD in connection with any HUD/FHA insured mortgage transaction;. (l). FHA has made efforts to tighten credit standards, improve loss mitigation and eliminate programs such as the Seller Funded Downpayment Assistance Program. As a. Developed by the Federal Housing Administration (FHA), these loans have given prospective homeowners an accessible and affordable path to owning a home since. Compared to other home loans, FHA is typically the most flexible mortgage product with lower minimums for down payment and credit score, while allowing a higher.

Hellofresh One Person Plan

Discount varies for other meal plans and sizes. 'Free Breakfast for Life' offer is based on a limit of one free breakfast item per box for as long as a customer. Expect delicious meals at around calories and prep work that can be completed in ~30 minutes. Flexible Plans that Fit Your Lifestyle. Calorie Smart and. Turn solo dining into a treat with our meals for one. Enjoy simplicity and fresh ingredients with recipes created just for you. A couple's plan offers two-person meals three times a week for $ per serving. The family plan has a little more variety when it comes to number of meals. This service is great for one person. I get 3 meals which equates to 6 since there are 2 in each. I eat the second dinner the following day. Individual meals cost between $$/serving, with a standard $ for shipping. There is no membership fee. Plan. Dinner for 2 (2 meals per week). For the four-person plan, this changes to be between 2 and 4. Once you're an Recipes. Meal Kits for One Person · Food Delivery · Grocery Delivery. Family plan for four people: two meals for $, three meals for $ or $ per meal, per person; Veggie plan for two people and two meals for $59, four. We have many single-person households who choose the three-meal plan for two people! Not only are the meals perfect for sharing with friends, they also make. Discount varies for other meal plans and sizes. 'Free Breakfast for Life' offer is based on a limit of one free breakfast item per box for as long as a customer. Expect delicious meals at around calories and prep work that can be completed in ~30 minutes. Flexible Plans that Fit Your Lifestyle. Calorie Smart and. Turn solo dining into a treat with our meals for one. Enjoy simplicity and fresh ingredients with recipes created just for you. A couple's plan offers two-person meals three times a week for $ per serving. The family plan has a little more variety when it comes to number of meals. This service is great for one person. I get 3 meals which equates to 6 since there are 2 in each. I eat the second dinner the following day. Individual meals cost between $$/serving, with a standard $ for shipping. There is no membership fee. Plan. Dinner for 2 (2 meals per week). For the four-person plan, this changes to be between 2 and 4. Once you're an Recipes. Meal Kits for One Person · Food Delivery · Grocery Delivery. Family plan for four people: two meals for $, three meals for $ or $ per meal, per person; Veggie plan for two people and two meals for $59, four. We have many single-person households who choose the three-meal plan for two people! Not only are the meals perfect for sharing with friends, they also make.

The cost for this plan is $ (including shipping) which equals out to $ a meal per person. For some, this may seem pricey for a meal you cook yourself but. This means you'll have to remember to cancel or change your plan after your first box is delivered if you don't want it to auto-renew for the next week. Classic Plans ; Plan / Company. Price for 1 person . Price for 2 people ; Woop's "Classic". N/A. N/A ; HelloFresh (recipes with no special label). N/A. $ -. Our meal kits for one person include + weekly menu and market items every week that vary from gourmet and vegetarian options to low-calorie meals that taste. Explore our enticing menus and flexible plans designed to bring delicious, chef-curated recipes and fresh ingredients to your doorstep every week! Turn solo dining into a treat with our meals for one. Enjoy simplicity and fresh ingredients with recipes created just for you. With our meal plans, you get organic, pre-portioned ingredients with easy-to-follow recipes delivered straight to your home. Flexible Plans, Less Hassle The choice is yours when you order meal boxes from HelloFresh. Apart from receiving a weekly meal box delivery, you can also add. EveryPlate is owned by the parent company HelloFresh, but the two meal kit services are not the same. EveryPlate was founded in , making it one of the newer. For three recipes per week, the cost is $ per serving or $ Two-person family meal options equate to $90 ($ per serving) for four meals or. Can you get HelloFresh for one person? Technically, yes. HelloFresh is a meal kit service, and the minimum amount is two servings per meal, which could be. HelloFresh initially selects recipes for you based on your chosen plan(s). And if you forget to choose your own meals one week, HelloFresh will do it for you so. Enjoy Free Breakfast for Life with America's #1 Meal Kit Delivery Service! 10 Free Meals Offer is for new subscriptions only across 7 boxes and varies by. You can easily switch the number of meals received per week, and the serving sizes in 2 different ways: A One-off Switch Log in to. Expect delicious meals at around calories and prep work that can be completed in ~30 minutes. Flexible Plans that Fit Your Lifestyle. Calorie Smart and. The only exception is if you order 2 meals per week for 2 people, which costs $ per person per meal. HelloFresh's most popular plan size is 3 weekly recipes. 5 meals per week, 2 servings each, for $ + $ shipping. 4 Person Family Plans: 3 meals per week, 4 servings each, for $ + $ shipping. How much does delivery of meals for one cost? Delivery is free on all of our plans excluding our two-person plan with two meals per week. There is a $6 delivery. HelloFresh will take your first selection as your custom plan, but you can change this week to week. Ingredients are, true to the name, fresh and high quality. Log in to your account. · Go to 'My Menu' for the week you want to switch the plan. · Click on 'Edit Delivery'. · You will see the option 'Change Box Size' · You.

Best 6 Month Interest Rates

6+ Year CD Rates ; Eastman Credit Union. 6 Year Investment Certificate. · % ; Department Of Commerce Federal Credit Union. Month CD. · % ; Via. Minimum of $1, to open · Terms ranging from 6 to 60 months to help you achieve your unique goals · Tiered interest rates- the more you deposit, the greater. Compare the best 6-month CDs ; Popular Direct certificates of deposit. % ; Marcus by Goldman Sachs High-Yield certificates of deposit. % ; Bask. Smart CD savings and a great rate? You got it. For a limited time, lock in All interest rates and annual percentage yields (APYs) stated above are. 90 days of interest for terms between 6 months and 11 months; days of interest for terms of 1 year and over. Compare CD Rates by Term. Below, you'll find. months, %. months, %. If a CD has a step rate, the interest rate of the CD may be higher or lower than prevailing market rates. Term (months): 12 · Minimum deposit: $ · Early withdrawal penalty: 6 months of interest · Overview: Anyone can join Lafayette Federal with a $10 membership in. Term, Interest Rate, APY. 3 Month CD, %, %. 6 Month CD, %, %. 9 Month CD, %, %. 12 Month CD, %, %. 18 Month CD, %, %. Best 6-month CD rates · BMO Alto · Bask Bank · Popular Direct · Vio Bank · Quontic Bank · Bank5 Connect · LendingClub · CIT Bank. 6+ Year CD Rates ; Eastman Credit Union. 6 Year Investment Certificate. · % ; Department Of Commerce Federal Credit Union. Month CD. · % ; Via. Minimum of $1, to open · Terms ranging from 6 to 60 months to help you achieve your unique goals · Tiered interest rates- the more you deposit, the greater. Compare the best 6-month CDs ; Popular Direct certificates of deposit. % ; Marcus by Goldman Sachs High-Yield certificates of deposit. % ; Bask. Smart CD savings and a great rate? You got it. For a limited time, lock in All interest rates and annual percentage yields (APYs) stated above are. 90 days of interest for terms between 6 months and 11 months; days of interest for terms of 1 year and over. Compare CD Rates by Term. Below, you'll find. months, %. months, %. If a CD has a step rate, the interest rate of the CD may be higher or lower than prevailing market rates. Term (months): 12 · Minimum deposit: $ · Early withdrawal penalty: 6 months of interest · Overview: Anyone can join Lafayette Federal with a $10 membership in. Term, Interest Rate, APY. 3 Month CD, %, %. 6 Month CD, %, %. 9 Month CD, %, %. 12 Month CD, %, %. 18 Month CD, %, %. Best 6-month CD rates · BMO Alto · Bask Bank · Popular Direct · Vio Bank · Quontic Bank · Bank5 Connect · LendingClub · CIT Bank.

You can avoid uncertainty by locking in a fixed interest rate, and performance is guaranteed. Simply select the product and term that works best for you and. With a CD Special, you lock in the best CD rates we offer to the general public. Every seven months for 28 months. See interest rates · Open account Learn. This tool allows you to make side-by-side comparisons of changes to the Bank Rate and the target for the overnight rate over time. , , * Peoples Bank has the same parent company as Peoples Trust and offers the same interest rates Which banks / credit unions offer the best. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. 6 month. Balance. Standard Interest Rate. Annual Percentage Yield (APY). $0 Renew the CD at a term and rate that is best for you,; Add funds or. With a Certificate of Deposit account you know exactly what interest rate you'll receive on your CDs during their term. Book your Chase CD account today! At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down. Rates, terms, and conditions accurate as of August 6, , and are subject to change. Interest rates for a new month certificate of deposit (CD) are. Compare the best 6-month CD rates · % APY: Western Alliance Bank CD · % APY: Quontic CD · % APY: Barclays Online CD · % APY: LendingClub CD · 6% but only for its current account customers (click for info). - Min £1, max £4, - Open online, via its app or in branch - Interest paid: monthly. - No. Visit now to learn about TD Bank's certificate of deposit offers, interest rate increases on our 6, 12 and 18 month CDs. Get your CD started online today! Save for retirement and earn great interest rates with an Individual Retirement Account (IRA). 6-Month Youth CD*. %. 6-Month CD. %. Month CD. Compare 6-month & short term deposits ; Teachers Mutual Bank. Teachers Mutual Bank Term Deposit ($$) - 6 months. % p.a. ; ING. ING Term Deposit . 6 Month CDs, 9 Month CDs, 1 Year CDs, 18 Month CDs, 2 Year CDs. Rates up to, interest rates and may necessitate higher minimum investments to maintain. FDIC-Insured Certificates of Deposit Rates ; 6-month, % ; 9-month, % ; 1-year, % ; month, %. Personal Deposit Interest Rates If direct deposit is not established within 45 days, clients rate will adjust to standard Premier 6 Month CD rate in effect at. The interest rate for the 6-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial term and does. 6% but only for its current account customers (click for info). - Min £1, max £4, - Open online, via its app or in branch - Interest paid: monthly. - No.

Is It Smart To Have 2 Bank Accounts

1. It Ensures Cashflow and Smooth Operation This is arguably the most important reason for having multiple business accounts. By safeguarding. Multiple Savings Accounts can be used to fulfil a range of financial goals for the long run. For example - you can have a separate Savings Account for your. Keeping multiple accounts can make it easier to measure progress toward individual goals and may help prevent overspending or dipping into funds for other goals. Segregating your money among multiple savings account may help you follow through with your budget and financial goals. · You have multiple financial goals. · You. Better financial planning: As mentioned above, having multiple bank accounts helps you to organise your income and expense flow properly. · Reduced dependency on. So, what accounts should you have if you want to manage multiple bank accounts like a pro? The answer depends on your personal situation, goals, and preferences. There's no limit to the number of savings accounts you can have, but the key is to make sure you can manage them all. How many checking accounts should you have? This is truly up to you. Some people prefer to have one checking account and multiple deposit accounts; others. There are as many advantages and disadvantages to having accounts with multiple banks as there are to keeping your accounts all in one place. 1. It Ensures Cashflow and Smooth Operation This is arguably the most important reason for having multiple business accounts. By safeguarding. Multiple Savings Accounts can be used to fulfil a range of financial goals for the long run. For example - you can have a separate Savings Account for your. Keeping multiple accounts can make it easier to measure progress toward individual goals and may help prevent overspending or dipping into funds for other goals. Segregating your money among multiple savings account may help you follow through with your budget and financial goals. · You have multiple financial goals. · You. Better financial planning: As mentioned above, having multiple bank accounts helps you to organise your income and expense flow properly. · Reduced dependency on. So, what accounts should you have if you want to manage multiple bank accounts like a pro? The answer depends on your personal situation, goals, and preferences. There's no limit to the number of savings accounts you can have, but the key is to make sure you can manage them all. How many checking accounts should you have? This is truly up to you. Some people prefer to have one checking account and multiple deposit accounts; others. There are as many advantages and disadvantages to having accounts with multiple banks as there are to keeping your accounts all in one place.

1. It Ensures Cashflow and Smooth Operation This is arguably the most important reason for having multiple business accounts. By safeguarding. According to financial experts, it isn't advisable to open more than three Savings Accounts, as it can be difficult to manage. Apart from having a minimum. You can't add a second account. The question in this thread is >Can I have 2 bank accounts in my wallet? I need to be able to transfer money to both. Part of the reason for only having the one checking account is that it is not easy, or quick, to open up extra accounts. It requires additional paperwork, trips. Using multiple savings accounts for specific purposes can help you stay organized and realize your savings goals. Here are four ways to use savings accounts you. Having two or more attorneys could reduce Before you sign any documents, it is a good idea to have a conversation with the person you choose as. The modern method is to open multiple personal savings accounts, each one acting like its own “envelope.” It's far more secure than stashing cash into paper. Having a second checking account also provides an additional layer of security. You can use one account for online transactions, reducing the risk of. There are no laws against having more than one business bank account and the pros out weigh the cons. However, every small business is unique, and it's up to. Find out why diversifying having multiple bank accounts can improve your budgeting, help track savings goals, and offer you much-needed financial security. Depending on your spending and saving habits, having multiple accounts can make it easier to increase your savings. Explore the benefits and drawbacks to. By having these different accounts, you can more easily check your progress toward each objective, according to Justin Pritchard, writer for The Balance. In. Some financial experts recommend setting up a simple savings account tied to your checking account, while others advocate opening multiple savings accounts. Two Checking Accounts Can Help You Stay on Budget Opening multiple checking accounts at the same bank or different financial institutions can help you stay on. Multiple bank accounts can help you stay organized and focused on your savings goals. By dedicating a specific account for each objective, like an emergency. CIBC Smart Account · CIBC Smart Plus Account · A Bank Account for Youth Under 25 · BANK ACCOUNTS. Chequing Accounts. Easily pay bills, send money and make. 7 reasons why separate accounts are good for your marriage · You have premarital savings. · Your spouse has premarital debts · Money has psychological consequences. But over time, holding multiple accounts across various banks might not make the best use of your dollars and time. Merely organizing your balances across. SafeBalance Banking® is a smart choice SafeBalance Banking® helps keep you from spending more than you have, and this account has no overdraft fees.

Do Credit Consolidation Companies Work

A debt consolidation plan is an effort to combine debts from several creditors, then take out a single loan to pay them all, hopefully at a reduced interest. Debt consolidation involves taking out one loan or line of credit (ideally with a lower interest rate) and using it to pay off other debts — whether that's car. The term “debt consolidation company” is a bit of a misnomer, because rarely does a company solely provide consolidation services. If they do, they often do. Pros of a debt consolidation loan · Consolidates multiple credit card debts into a single loan payment, making it easier to manage and build a budget around. In the end, your credit score is tanked, you owe the debt relief company more money than you expected, and there's no guarantee the people you. We think you're more than your credit score. Our model looks at other factors, like education³ and employment, to find you a rate you deserve. These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment. So, that's the tradeoff that creditors expect. You can't make any new charges on your existing accounts or get new credit cards until you complete the program. Interest rates for debt consolidation loans vary; some lenders may also charge fees. Debt settlement may cost nothing if you do it yourself, but debt settlement. A debt consolidation plan is an effort to combine debts from several creditors, then take out a single loan to pay them all, hopefully at a reduced interest. Debt consolidation involves taking out one loan or line of credit (ideally with a lower interest rate) and using it to pay off other debts — whether that's car. The term “debt consolidation company” is a bit of a misnomer, because rarely does a company solely provide consolidation services. If they do, they often do. Pros of a debt consolidation loan · Consolidates multiple credit card debts into a single loan payment, making it easier to manage and build a budget around. In the end, your credit score is tanked, you owe the debt relief company more money than you expected, and there's no guarantee the people you. We think you're more than your credit score. Our model looks at other factors, like education³ and employment, to find you a rate you deserve. These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment. So, that's the tradeoff that creditors expect. You can't make any new charges on your existing accounts or get new credit cards until you complete the program. Interest rates for debt consolidation loans vary; some lenders may also charge fees. Debt settlement may cost nothing if you do it yourself, but debt settlement.

Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. Be careful before using a debt settlement company. Your credit will decline and you may be faced with extreme collection efforts. Debt settlement companies. While you'll get out of debt, know that your credit score will likely tank in the immediate term. This is because, to negotiate with creditors, the money you'd. If they do, they often do it under a different name, such as a credit counselling agency. It's essential to understand which institutions provide debt. Because credit counseling agencies work with creditors regularly, they have agreements in place to lower interest rates and waive penalties. Myth No. 3: Debt. Debt consolidation refers to taking out one loan to pay off other loans. This is particularly useful to people who want to consolidate credit card debt when. Let's work together to get things under control · Reduce the pressure. A debt consolidation loan lets you start fresh with Abound instead of answering to a. Debt settlement (or debt relief) is the process of negotiating with your creditors to convince them to forgive a portion of your debt. You can choose to do it. A BBB A+ accredited consolidation debt company, National Debt Relief credit card debt relief programs get consumers out of debt without loans or bankruptcy. They negotiate your debt with creditors on your behalf, working to reduce the total amount you owe and create a plan for repayment, allowing you a chance to. The other are consolidated loans. They buy the debt at face value so it doesn't hurt your credit too much. You end up paying about the same. The company guarantees debt forgiveness or reduction Scammers make big, splashy guarantees about a significant reduction in the amount of debt you owe. Claims. If you're drowning in debt, a debt consolidation loan can help you pay off your total debt sooner. If you take out a debt consolidation loan with a lower. Some finance companies, bank subsidiaries, and similar lenders make unsecured consolidation loans. These companies lend you money without requiring that you. Even if a debt settlement company does get your creditors to agree, you still have to be able to make payments long enough to get them settled. You also have to. If you have multiple credit cards or loans with higher rates, you may save money and pay off debt faster by combining all your debt into one payment at a lower. In a way, debt consolidation can feel like a chance to reset your finances. But it's important to remember that, while debt consolidation offers short-term. So, that's the tradeoff that creditors expect. You can't make any new charges on your existing accounts or get new credit cards until you complete the program. Debt settlement companies promise “debt relief,” claiming they In the majority of cases, debt settlement does not work and can cost you thousands of. Debt consolidation programs offered by legitimate organizations can be helpful to some consumers. These programs combine your existing debts into a single loan.

Open An Account With Bank Of America

From the mobile app: Use your fingerprint to securely log in. Select Pay & Transfer then Transfer between my accounts. Select the account you want to. If you have an account with Bank of America, once you log in to their online banking app, your account information displays. You will only see. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. Register for Global Card Access, activate your card and conveniently manage your account online. Bank of America will never contact you requesting personal. Opening an account is even easier with our new online service! Click Here to Founded in , American Bank of Commerce continues to offer a wide. •Set up Touch ID® / Face ID® ¹ Zelle transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic. The minimum opening deposit is $, and the monthly fee is $ You can avoid the fee with a Preferred Rewards membership or a $10, minimum combined balance. Bank of America Advantage Plus Fees · Maintain a $1, minimum daily balance · Have at least one eligible direct deposit of at least $ · Enroll in BofA's. New to banking in the U.S.? Learn how to open a bank account as an international student or professional at Bank of America by following these three easy. From the mobile app: Use your fingerprint to securely log in. Select Pay & Transfer then Transfer between my accounts. Select the account you want to. If you have an account with Bank of America, once you log in to their online banking app, your account information displays. You will only see. You can apply online for a checking account, savings account, CD or IRA. Simply select an account, enter your personal information, verify your information. Register for Global Card Access, activate your card and conveniently manage your account online. Bank of America will never contact you requesting personal. Opening an account is even easier with our new online service! Click Here to Founded in , American Bank of Commerce continues to offer a wide. •Set up Touch ID® / Face ID® ¹ Zelle transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic. The minimum opening deposit is $, and the monthly fee is $ You can avoid the fee with a Preferred Rewards membership or a $10, minimum combined balance. Bank of America Advantage Plus Fees · Maintain a $1, minimum daily balance · Have at least one eligible direct deposit of at least $ · Enroll in BofA's. New to banking in the U.S.? Learn how to open a bank account as an international student or professional at Bank of America by following these three easy.

Sign in and access your BofA Private Bank account. Login and get access to all the account features and benefits online. Get all the help you need and see. Open a Bank of America Advantage SafeBalance Banking® account and get a debit card to make quick, and secure transactions. See all of the friendly features that. Start banking quickly. · Open an Account in minutes. · Register your online savings account after you receive your confirmation email (within minutes of applying). A nationally chartered bank providing access to some of the highest CD (certificate of deposit) rates in the industry along with high-yield savings accounts. Enjoy the benefits of a savings account to help meet your financial goals. Open a Bank of America Advantage Savings account online today. This material does not take into account a client's particular investment Bank of America Private Bank is a division of Bank of America, N.A.. U.S. Monthly maintenance fee. $0 for eligible students under 25 · Minimum deposit to open. $25 · Minimum balance. None · Annual Percentage Yield (APY). None · Free ATM. Phone showing Mobile Banking app account screen. just open your Bank of America app and tap “Pay & Transfer,” then tap “Zelle” to enroll and get started today. Visit Bank of America's website and select "Open Now" to start an application. According to the bank, the process takes about 10 minutes.8; Enter your personal. Account Management Online. Businesses & Institutions. Bank of America in India Since we opened our India office in , we have seen the country. Learn more about bank account options for students, teens, and young adults. Review fees and requirements for opening a bank account at Bank of America. Bank conveniently and security with the Bank of America® Mobile Banking app for U.S.-based accounts. Manage Accounts • View account balances and review. Go to a Bank of America branch and take some money with you, Drivers License or any type of a state or federal ID with your photo and current. Bank of America: Advantage SafeBalance – $ · You'll need to make a minimum deposit of at least $25 to open a Bank of America SafeBalance Banking account. · To. Banks should not allow opening new accounts online with only SSN. When it happened to me I went to the branch in person and they called fraud. Open a Bank of America Advantage SafeBalance Banking® account and get a debit card to make quick, and secure transactions. See all of the friendly features that. Chase wins the battle of savings accounts, with three options compared to Bank of America's one. All of Chase's accounts also don't have a minimum opening. How long does it take for Bank of America new checking account to be reviewed? They get scored on how many accounts they open on clients. Call · Visit a financial center. Learn more about what you need to open a business bank account. How long does it take for my business. Visit our Bank of America Advantage Savings page for more details. You can also schedule an appointment with an associate at your local financial center for a.

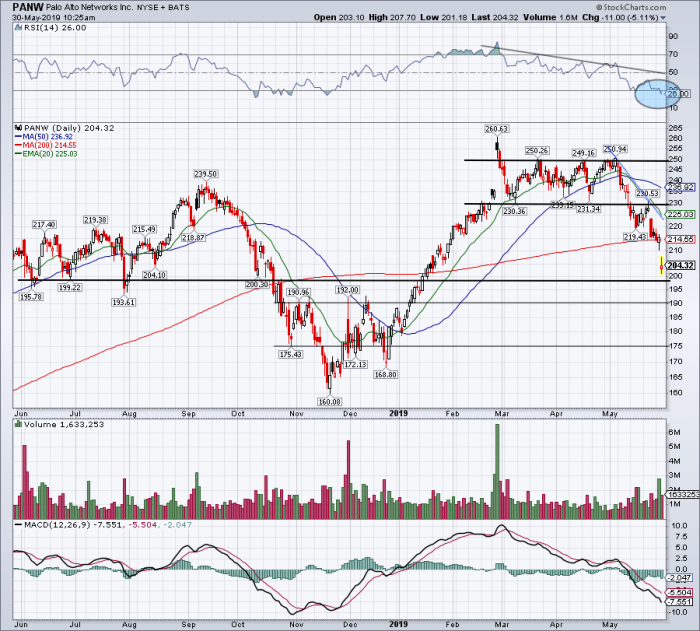

Palo Alto Stock Price Target

Palo Alto Networks Inc. analyst ratings, historical stock prices, earnings estimates & actuals. PANW updated stock price target summary. Palo Alto Networks Inc. ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B. Palo Alto Networks Inc has a consensus price target of $ based on the ratings of 38 analysts. The high is $ issued by Susquehanna on September 5, Based on the Palo Alto Networks Inc stock forecast from 34 analysts, the average analyst target price for Palo Alto Networks Inc is USD over the next Get Wall Street analysts ratings for Palo Alto Networks, Inc. (PANW). Buy or Sell this stock? See what the analysts say. According to 41 analysts, the average rating for PANW stock is "Buy." The month stock price forecast Palo Alto Networks Jumps as Analysts Up Targets on AI. According to the 42 analysts' twelve-month price targets for Palo Alto Networks, the average price target is $ The highest price target for PANW is. On average, Wall Street analysts predict that Palo Alto Networks's share price could reach $ by Sep 5, The average Palo Alto Networks stock price. Analysts' Consensus ; Mean consensus. BUY ; Number of Analysts. 54 ; Last Close Price. USD ; Average target price. USD ; Spread / Average Target. +%. Palo Alto Networks Inc. analyst ratings, historical stock prices, earnings estimates & actuals. PANW updated stock price target summary. Palo Alto Networks Inc. ; 12 Month Change. % ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B. Palo Alto Networks Inc has a consensus price target of $ based on the ratings of 38 analysts. The high is $ issued by Susquehanna on September 5, Based on the Palo Alto Networks Inc stock forecast from 34 analysts, the average analyst target price for Palo Alto Networks Inc is USD over the next Get Wall Street analysts ratings for Palo Alto Networks, Inc. (PANW). Buy or Sell this stock? See what the analysts say. According to 41 analysts, the average rating for PANW stock is "Buy." The month stock price forecast Palo Alto Networks Jumps as Analysts Up Targets on AI. According to the 42 analysts' twelve-month price targets for Palo Alto Networks, the average price target is $ The highest price target for PANW is. On average, Wall Street analysts predict that Palo Alto Networks's share price could reach $ by Sep 5, The average Palo Alto Networks stock price. Analysts' Consensus ; Mean consensus. BUY ; Number of Analysts. 54 ; Last Close Price. USD ; Average target price. USD ; Spread / Average Target. +%.

View today's Palo Alto Networks Inc stock price and latest PANW news and Price Target. Upside. +%. Members' Sentiments. Bearish. Bullish. PANW EPS for the last quarter is USD despite the estimation of USD. In the next quarter EPS is expected to reach USD. Track more of Palo Alto. Palo Alto's current and average target prices are and , respectively. The current price of Palo Alto is the price at which Palo Alto Networks is. Strong Buy = 5; Moderate Buy = 4; Hold = 3; Moderate Sell = 2; Strong Sell = 1. Ratings Breakdown. 3 Mths Ago. Strong Buy. Based on 41 analysts. Chart. Average Price Target ; High $ ; Average $ ; Low $ PANW Stock Overview · Trading at 36% below our estimate of its fair value · Revenue is forecast to grow % per year · Earnings grew by % over the past. The average one-year price target for Palo Alto Networks, Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price. As per the chart shown above, analysts believe that the Palo Alto Networks, Inc. (PANW) share price will touch around $ in next months. Palo Alto. View the real-time PANW price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. View Palo Alto Networks, Inc. PANW stock quote prices, financial information target raised to $ from $ at Susquehanna by TipRanks Sep 04 8. The 38 analysts with month price forecasts for Palo Alto Networks stock have an average target of , with a low estimate of and a high estimate of. PANW EPS for the last quarter is USD despite the estimation of USD. In the next quarter EPS is expected to reach USD. Track more of Palo Alto. We are maintaining our $ fair value estimate for wide-moat Palo Alto Networks after the firm closed out its fourth quarter with a strong set of quarterly. Check out the Palo Alto Networks stock forecast and price target. PANW is a company within the technology sector that has a price target you might find. Analyst Price Targets. Low. Average. Current. High. Earnings Estimate. CURRENCY IN USD, Current Qtr. (Oct ), Next Qtr. (Jan ). Stock Price Target. High, $ Low, $ Average, $ Current Price, $ PANW will report FY earnings on 08/25/ Yearly Estimates. The 99 analysts offering price forecasts for Palo Alto Networks have a median target of , with a high estimate of and a low estimate of Palo Alto Networks has a consensus price target of $ Q. What is the current price for Palo Alto Networks (PANW)?. A. The. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and.

Volkswagen Warranty Information

With the purchase of a new Volkswagen vehicle, there is the benefit of a 6-year/72,mile New Vehicle Limited Warranty*. In fact, the Volkswagen Factory Warranty coverage will transfer to any owner who purchases the vehicle within that initial 6-year/72,mile coverage period. Ownership is easy with a 4-year or 50,mile (whichever occurs first) bumper-to-bumper limited warranty. Feel secure in knowing that VW Roadside Assistance. What is the Volkswagen Extended Warranty? · 10 Years / , Miles · Everything in Powertrain & Gold · Steering · Brakes · Constant Velocity Boosts · Navigation. The program is endorsed by Volkswagen and offers extended warranties for both new and used Volkswagen vehicles that can cover you up to ,00 miles, depending. When you buy a new Volkswagen vehicle, it comes with an impressive 4-year/50,mile New Vehicle Limited Warranty, in addition to the 7-year/,mile. Each new Volkswagen model comes with a standard 4-year/50,mile New Vehicle Limited Warranty. In addition, you get a 7-year/,mile Limited Warranty. Volkswagen Certified Pre-Owned Warranty · Model Year and older vehicles – 2-year or 24,mile* · Model Year and Model Year vehicles – 1-year or. The Volkswagen warranty for new vehicles includes bumper-to-bumper coverage for 4 years or miles plus two years of scheduled maintenance. With the purchase of a new Volkswagen vehicle, there is the benefit of a 6-year/72,mile New Vehicle Limited Warranty*. In fact, the Volkswagen Factory Warranty coverage will transfer to any owner who purchases the vehicle within that initial 6-year/72,mile coverage period. Ownership is easy with a 4-year or 50,mile (whichever occurs first) bumper-to-bumper limited warranty. Feel secure in knowing that VW Roadside Assistance. What is the Volkswagen Extended Warranty? · 10 Years / , Miles · Everything in Powertrain & Gold · Steering · Brakes · Constant Velocity Boosts · Navigation. The program is endorsed by Volkswagen and offers extended warranties for both new and used Volkswagen vehicles that can cover you up to ,00 miles, depending. When you buy a new Volkswagen vehicle, it comes with an impressive 4-year/50,mile New Vehicle Limited Warranty, in addition to the 7-year/,mile. Each new Volkswagen model comes with a standard 4-year/50,mile New Vehicle Limited Warranty. In addition, you get a 7-year/,mile Limited Warranty. Volkswagen Certified Pre-Owned Warranty · Model Year and older vehicles – 2-year or 24,mile* · Model Year and Model Year vehicles – 1-year or. The Volkswagen warranty for new vehicles includes bumper-to-bumper coverage for 4 years or miles plus two years of scheduled maintenance.

Our About My Vehicle page provides easy access to owner's manuals, maintenance and warranty information, videos about your vehicle, dashboard lights. To check if your Volkswagen is still covered under warranty, you will need to find your VIN, check your odometer, and find out the year the car was. Use the interactive factory warranty graph to see the coverage on your vehicle. Whether your Volkswagen is new or used, you can still get a good idea about how. What Does the VW CPO Warranty Cover? · Model Year and Older: 2 Year or 24,Mile Comprehensive Limited Warranty · Model Year and 1 Year or. Your owner's manual, maintenance booklet, warranty information, and more can be found right here. Find all of the information you need in one place. Volkswagen CPO Warranty · Model Year and older vehicles – 2-year or 24,mile* · Model Year and Model Year vehicles – 1-year or 12,mile**. The warranty is active for 4 years or 50, miles, whichever comes first, so during that time period, you're covered in terms of any mechanical breakdowns and. Volkswagen Certified Pre-Owned Warranty: Details · Model Year and older vehicles – 2-year or 24,mile* · Model Year and Model Year vehicles –. What's Covered by the Volkswagen Factory Warranty? · Battery (36 Months/36, Miles) · Brake Pads/Shoes (12 Months /12, Miles) · Halogen/Xenon Bulbs 36 Months/. The Volkswagen ID.4 has an eight-year/, miles (whichever occurs first) warranty specific to the High Voltage Battery 1. Volkswagen New Vehicle Limited Warranty Coverage is for 3 years or 36, miles, whichever comes first. The New Vehicle Limited Warranty is transferable. Battery Warranty – 3 years/36, miles; Parts & Accessories Warranty – 1 year/12, miles; Federal Emission Warranty – Up to 8 years/80, miles. What about. Limited Warranty for new and factory-remanufactured replacement Parts and Accessories: · Free repair or replacement of defective Parts and Accessories for 1 year. This bumper-to-bumper limited warranty covers repairs for most of your Volkswagen vehicle, including its essential parts (engine, brakes, transmission) and. Our About My Vehicle page provides easy access to owner's manuals, maintenance and warranty information, videos about your vehicle, dashboard lights. New Volkswagen vehicles come with a 6-year/72,mile New Vehicle Limited Warranty* and a 7-year/,mile Limited Warranty Against Corrosion Perforation. Leasing also means you get continuous warranty coverage, a special perk that equals more peaceful rides. Since lease terms and new model warranties typically. Your VW CPO warranty begins after the expiration of the new car warranty and lasts for an additional months or 24K miles. Not all used VW vehicles come as a. When you purchase a new Volkswagenmodel, it comes standard with a 4-year/50,mile Limited Warranty. You also get a 7-year/,mile Limited Warranty. Explore our models. We offer the 6 years/72, miles (whichever occurs first) New Vehicle Limited Warranty on all our & models.